If Ponzi Customers Get Their Money Back, Why Not DHFL?

If Ponzi Customers Get Their Money Back, Why Not DHFL?

If Ponzi Customers Get Their Money Back, Why Not DHFL?

Posted on 13/04/2024 (GMT 20:05 hrs)

OBMA has observed a curious phenomenon. While looking through the history of the economy of India over the decades, there are a few instances from the past era that show how beleaguered chit funds/Ponzi scheme companies (shadow economy) were able to give the money back to the affected depositors upon governmental intervention within few years of the attestation of their “fishy” businesses.

Given below are few such positive instances:

SAHARA

Scam Revealed On: January 2011

Matter Resolved On: 2023

Sahara-Sebi refund: Rs 25,000 crore of Sahara depositors stuck; What is the Consolidated Fund of India VIEW HERE ⤡ (As reported on 21st November, 2023 ©The Economic Times)

Rags-to-riches Indian tycoon Subrata Roy accused of scamming 30 million people dies at 75 VIEW HERE ⤡ (As reported on 15th November, 2023 ©The National News)

NSEL

Scam Revealed On: 2013

Matter Resolved On: May 2016

NSEL e-gold investors start getting refunds VIEW HERE ⤡ (As reported on 12th March, 2018 ©Businessline)

NSEL scam in Mumbai: 95% of small investors get money back VIEW HERE ⤡ (As reported on 21st March, 2022 ©The Times of India)

Over 8k investors out of 13k get back money lost in Jignesh Shah’s NSEL scam VIEW HERE ⤡ (As reported on 8th April, 2024 ©The Hindustan Times)

ROSE VALLEY

Scam Revealed On: July 2013

Matter Resolved On: May 2016

Rose Valley investors to get money back VIEW HERE ⤡ (As reported on 25th May, 2016 ©The Times of India)

ALCHEMIST GROUP

Scam Revealed On: 2010-13

Matter Resolved On: 2018-2020

Alchemist Group investors to get their money back VIEW HERE ⤡ (As reported on 14th June, 2018 ©milenniumpost)

Chit fund depositors money: Calcutta HC directs committee to refund Vibgyor Group investors VIEW HERE ⤡ (As reported on 11th October, 2020 ©Zee Business)

If the depositors of these chit-funds are getting their money back within the span of few years, why not the lakhs of small depositors (FD-NCD Holders) of an AAA-rated NBFC/shadow bank, viz., the DHFL?

Is it because of the following possibilities:

- The IBC (2016), brought out by the present ruling party, the BJP, had to be “tested out” in positive lights to portray the government in favourable terms? Was the DHFL case chosen as a “litmus test” case without trying to set up a “bad precedent” consciously/deliberately to legitimize the ill-conceived IBC? Hence, the DHFL was MADE to undergo the CIRP, which led to the huge haircuts for the small depositors.

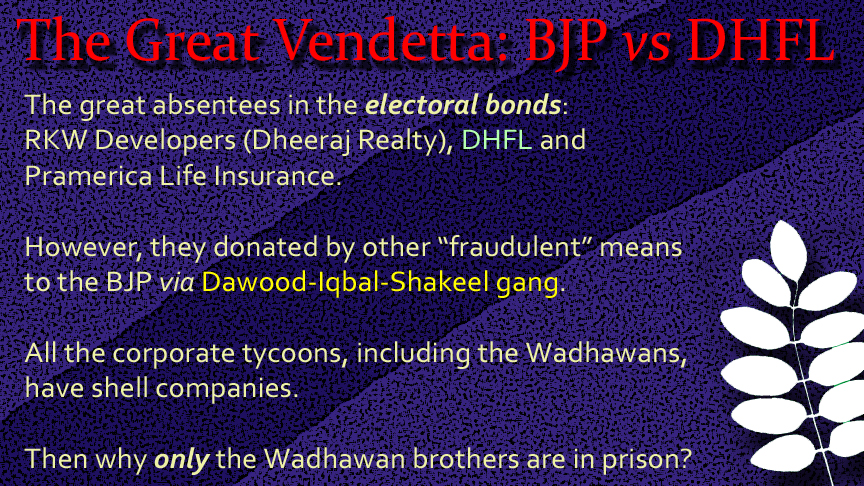

- The name of the Wadhawan Brothers or their companies do not even figure in the list of electoral bond buyers (we do not know if they donated via electoral bonds through shell companies)! Was putting the DHFL into insolvency a vengeful action on the part of the BJP, which was enraged for not receiving their bribes from the Wadhawans through the mode of Electoral Bonds? However, the Wadhawans were in fact connected to the BJP’s “donation dynamic” through terror-funding via the channel of Dawood-Iqbal-Shakeel-RKW Developers-DHFL!

- ‘False’ (?!) allegations on the collusion among the BJP, Dawood-Mirchi and the DHFL: A Letter to the BJP President VIEW HERE ⤡

- AN RTI ON THE ALLEGED COLLUSION AMONG DAWOOD-MIRCHI-RKW-DHFL-BJP VIEW HERE ⤡

- The entire DHFL saga appears to be predetermined to meet a quid pro quo “due” to Mr. Ajay Piramal (secondary kin of BJP’s favoured Mukesh Ambani). Piramal bought BJP minister Piyush Goyal’s company at 1000 times its face value in the Flashnet Scam. The BJP HAD TO give the DHFL as a “gift” to Mr. Piramal, irrespective of the standing circumstances, for their long-standing affinity or crony friendship. Piramal donated a sum of 85 crores (as revealed till now; might be more) through electoral bonds alone!

DIFFERENCE BETWEEN PONZI SCHEME AND NBFC: A Ponzi scheme is an investment fraud that pays existing investors with funds collected from new investors. Ponzi scheme organizers often promise to invest your money and generate high returns with little or no risk. But in many Ponzi schemes, the fraudsters do not invest the money. On the other hand, an NBFC has a totally different, secured character. A Non-Banking Financial Company (NBFC) is a company registered under the Companies Act, 1956 engaged in the business of loans and advances, acquisition of shares/stocks/bonds/debentures/securities issued by Government or local authority or other marketable securities of a like nature, leasing, hire-purchase, insurance business, chit business but does not include any institution whose principal business is that of agriculture activity, industrial activity, purchase or sale of any goods (other than securities) or providing any services and sale/purchase/construction of immovable property. A non-banking institution which is a company and has principal business of receiving deposits under any scheme or arrangement in one lump sum or in installments by way of contributions or in any other manner, is also a non-banking financial company (Residuary non-banking company). It is under the Reserve Bank of India (RBI).

Comments

Post a Comment